Comparison Case Study to compare and contrast four different locations across Des Moines, IA

Table of Contents

- Background on Project

-

What Actionable Insights Did the Client Gather from this Case study?

- About the Author

Background on Project

A commercial real estate client approached Near to analyze and compare four Des Moines area shopping centers and provide insights about each location’s customers.

-png-4.png)

Use Case Questions:

Reports used:

How do the shopping center trade areas compare?

The Optimal Geospace report is an excellent way to determine the reach of a location based on where people live and work, and how they get to/from a location. Using this report on the four different shopping centers in Des Moines, we are able to see the draw that each location has and compare locations.

-png.png)

Based on the visualization above, Site 1 has a much larger trade area that also extends into the trade areas of Site 2 and Site 3. Site 2 and 3 are very similar to one another and extend into similar residential and commercial areas. Site 4 is located to the east on a major highway, where its trade area is mostly centralized.

What do the Demographics of Each Shopping Center Look like?

The Demographics report is the key report used to make this assessment, where we are able to get a report on the demographics of visitors to multiple areas.

-png-2.png?width=688&name=Des%20Moines%20Case%20Study(1)-png-2.png)

The shopping centers all have very similar demographics breakdowns, where visitors to each of the areas tend to come from areas associated with educated middle class families. Those that visited Sites 2 and 3 are more affluent than visitors to other areas, and Site 3 also saw more visitors during the study time frame than the other locations.

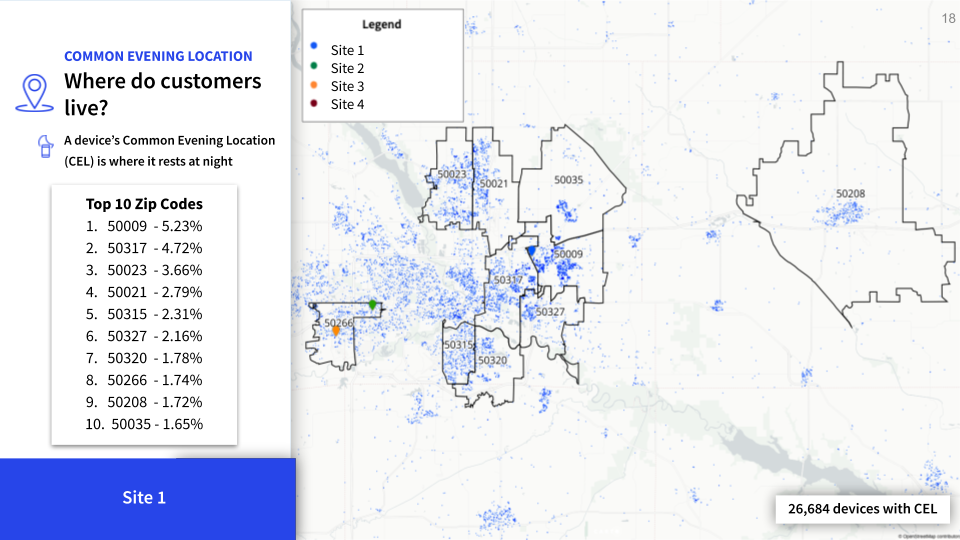

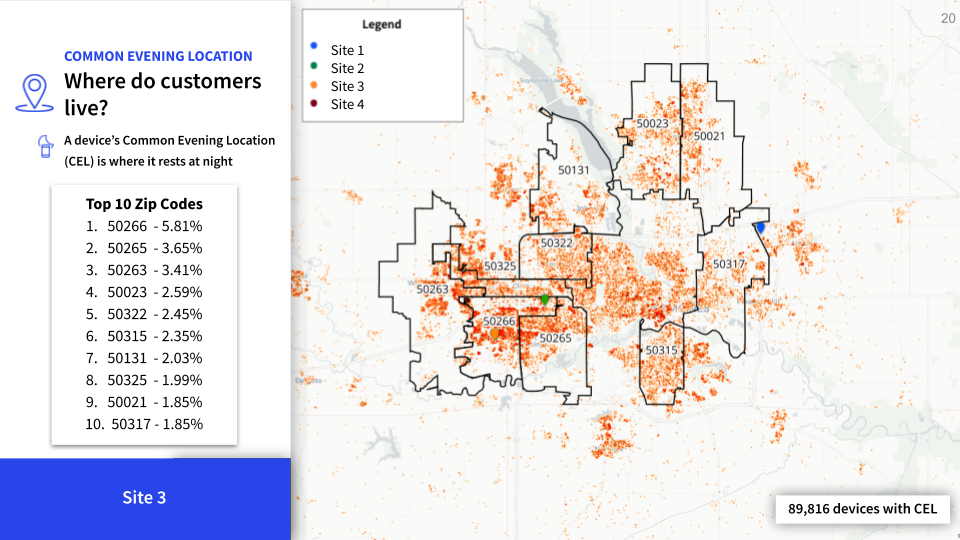

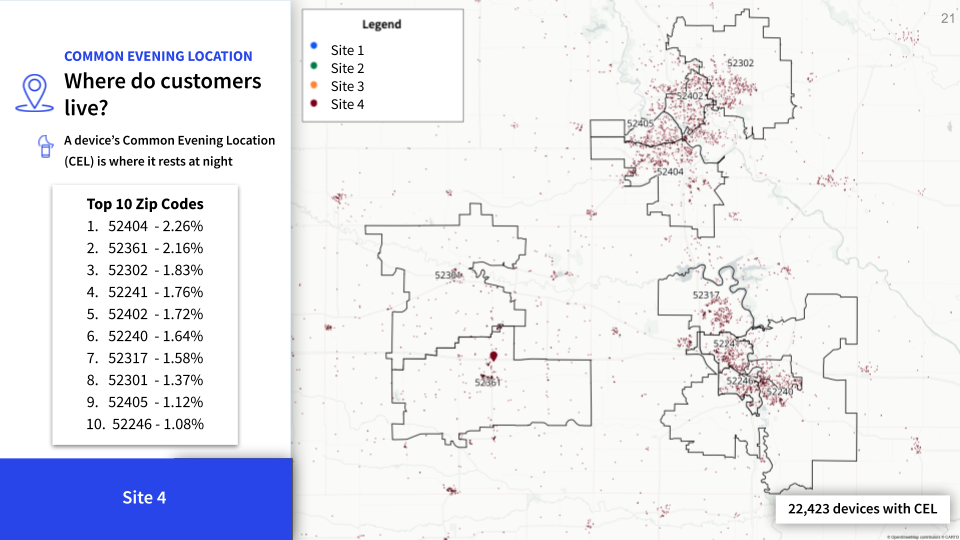

Where Do Visitors To Shopping Areas Live?

The Common Evening Location - Common Daytime Location Distance Report allows a user to visualize and understand the origin markets of visitors to a location. For this case study, the report provided critical information on where visitors to each location are coming from when visiting each location.

The majority of visitors to Site 1 live within the same zip code as the shopping center. About 5.25% of all visitors to the area live within 50009. Site 1 has a somewhat far reach, bringing in a large amount of visitors from a zip code relatively far away.

-png.png)

Site 2 has a strong local reach, where its top 10 zip codes are located nearby. The majority of its draw comes from within the city of Des Moines.

Similar to site 2, Site 3 has a strong appeal to local residents located within Des Moines. Although its reach is not as far as a location like Site 1, Site 3 draws in about 3 times more visitors.

Site 4 is located much farther away from Des Moines than the other locations, and its draw area reflects that. It sees many more visitors from Iowa City and Cedar Rapids than from the Des Moines area. The location is not as strong locally, but it brings in almost as many visitors as Site 1 from two major cities.

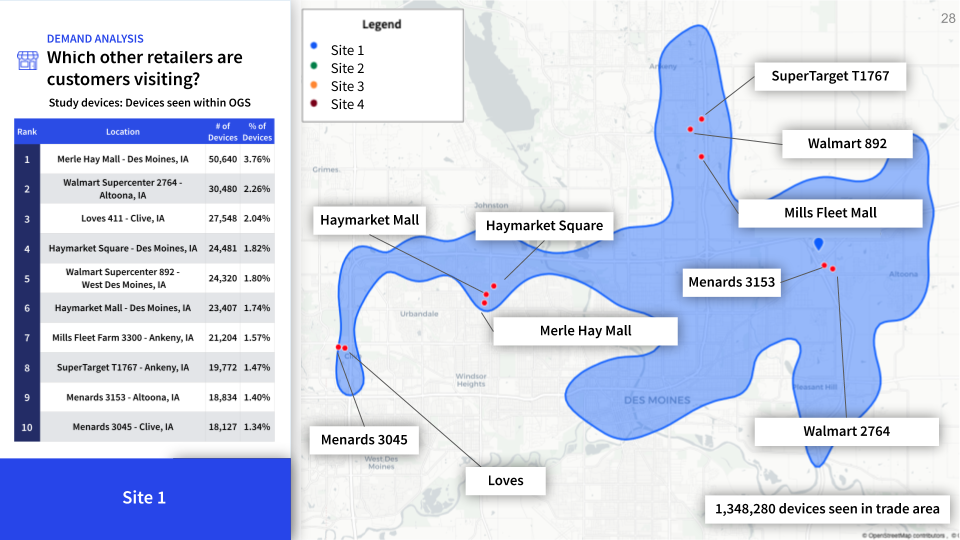

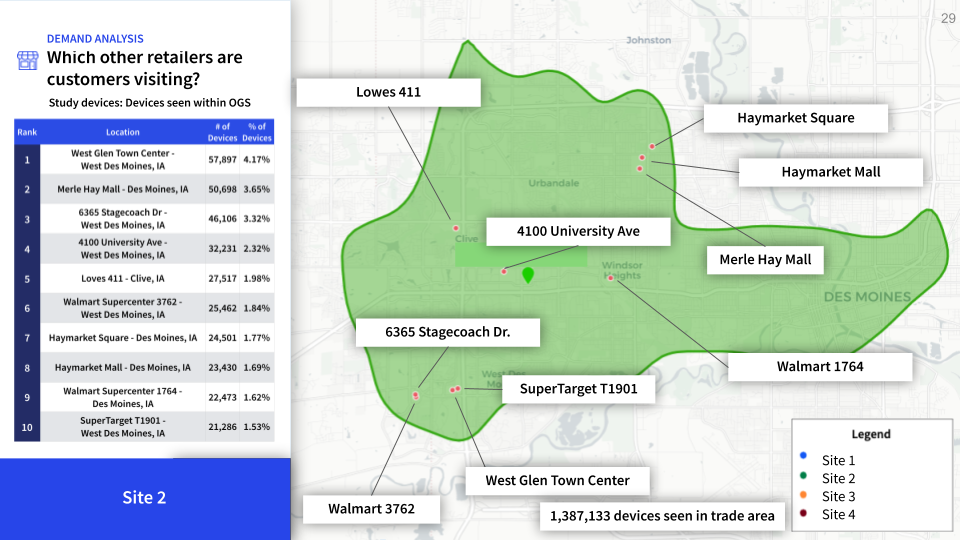

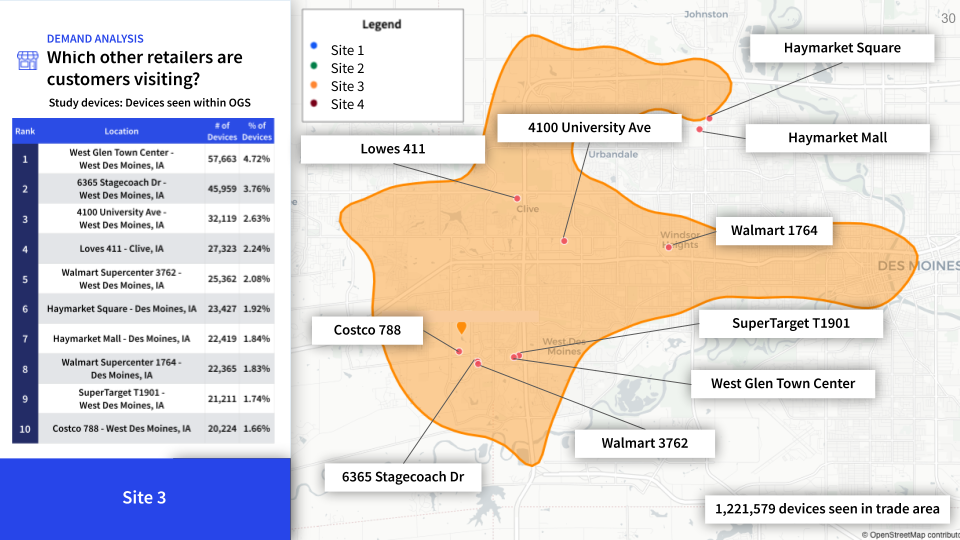

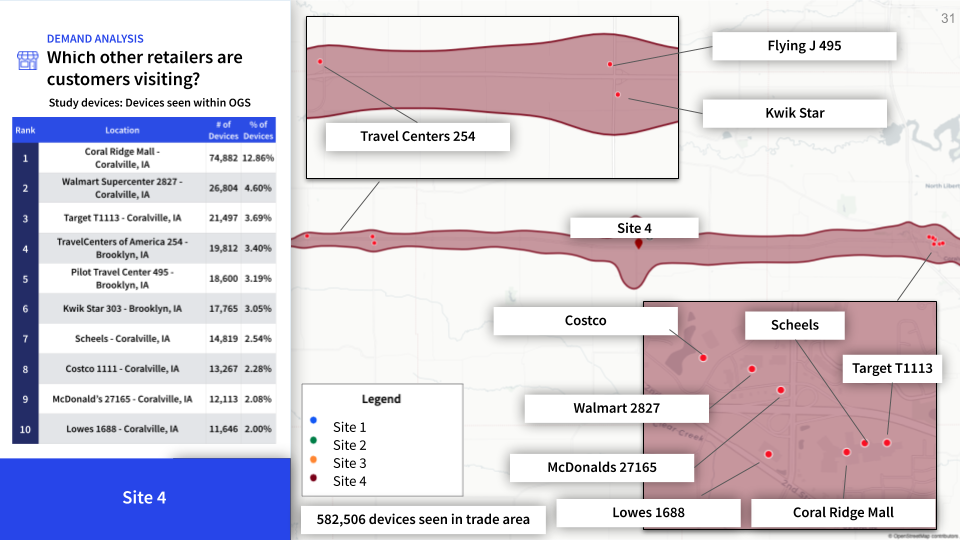

Where else do visitors to each area like to visit?

An analysis like this can be done using a combination of Near reports, where one can use the Optimal GeoSpace report to gather information on a locations trade area. From there, one can reference an Zero Point Report to determine where those in a trade area visit. Both reports were used to identify locations within each Sites trade area and determine shopping habits for visitors to a site.

Site 1's trade area encompasses a number of malls and big box stores, implying that visitors to Site 1 are likely to visit malls for their shopping.

Site 2 sits in between two highly visited shopping centers, the West Glen Town Center and the Merle Hay Mall. Those two lie directly within the trade area of Site 2, pointing to the possibility of strong competition from those malls.

Site 3's trade area also contains the West Glen Town Center, which is a highly visited location. Similar to Site 2, the West Glen Town Center will most likely be Site 3's strongest competitor location.

Site 4 does not have any nearby locations where people tend to shop at within its trade area. The majority of foot traffic in its trade area is located to the east towards Iowa City. The top location there being the Coral Ridge Mall. Site 4's location will not necessarily have much nearby competition but it may have to deal with competition from closer to the major city.

What Actionable Insights Did the Client Gather from this Case Study?

The client was able to understand the pros and cons of opening their location in each site. Site 1 is an excellent location for its potential draw power but does not see as many visitors. Site 2 and 3 bring in a large amount of visitors and foot traffic due to their locations but have somewhat strong local competition. Site 4 does not have strong local competition and is located in an accessible area but does have competition from the major city located nearby.

With these insights, the client was able to find and connect with the site that most closely aligned with their goals. Mobile location data was key to this site comparison case study and is just one example of the use cases that it excels at.

Insights provided by Near in this study are aggregated and de-identified, not tied to any single device or individual. Near adheres to GDPR and CCPA and has been certified for privacy compliance by Verasafe, an independent third party.

About the Author

Raul is Near's in-house Tableau and ESRI expert with background in microbiology. He is passionate about using science and art to craft stories that excite and inspire, and wants to help you do the same.